In today’s fast-moving field-service industry, gaining field-service industry insights is essential for staying competitive. These insights allow business owners to understand market trends, anticipate customer needs, and make data-driven decisions faster than competitors. Without a system for collecting and analyzing field-service industry insights, even the most experienced leaders can fall behind in a rapidly evolving market.

Whether you run an HVAC, plumbing, electrical, or general service business, leveraging the right intelligence can mean the difference between growing your market share or losing it to competitors who act faster. In 2025, the most successful leaders aren’t just managing operations—they are actively gathering and applying field-service industry insights to make smarter decisions every day.

This guide will show you where top field-service leaders get their intelligence and how you can build a sustainable system that turns insights into measurable business outcomes.

The Problem Nobody’s Talking About

Running a field-service business is demanding. Leaders are constantly juggling:

- Scheduling and dispatching

- Customer complaints and satisfaction

- Technician productivity and retention

- Billing, invoicing, and operational efficiency

Amid these daily tasks, analyzing field-service industry insights often seems like a luxury. Many business owners assume market intelligence is only for large enterprises with dedicated research teams.

The truth is, the most competitive field-service leaders are data-driven and proactive, leveraging insights from multiple sources to anticipate trends, optimize operations, and improve customer satisfaction—without disrupting daily business.

Why Traditional Approaches Are Failing

For decades, field-service leaders relied on slow-moving sources for insights:

- Trade magazines: Monthly or quarterly publications that are often outdated by the time they arrive.

- Industry conferences: Expensive, time-consuming, and easy to forget within weeks.

- Networking calls: Limited to your personal contacts and experiences.

- Consulting reports: Generic, high-level information that often lacks actionable steps.

The problem: these methods are reactive. Leaders who wait for reports are always behind the curve.

In contrast, top-performing field-service businesses in 2025 build real-time intelligence systems, using field-service industry insights to make proactive decisions.

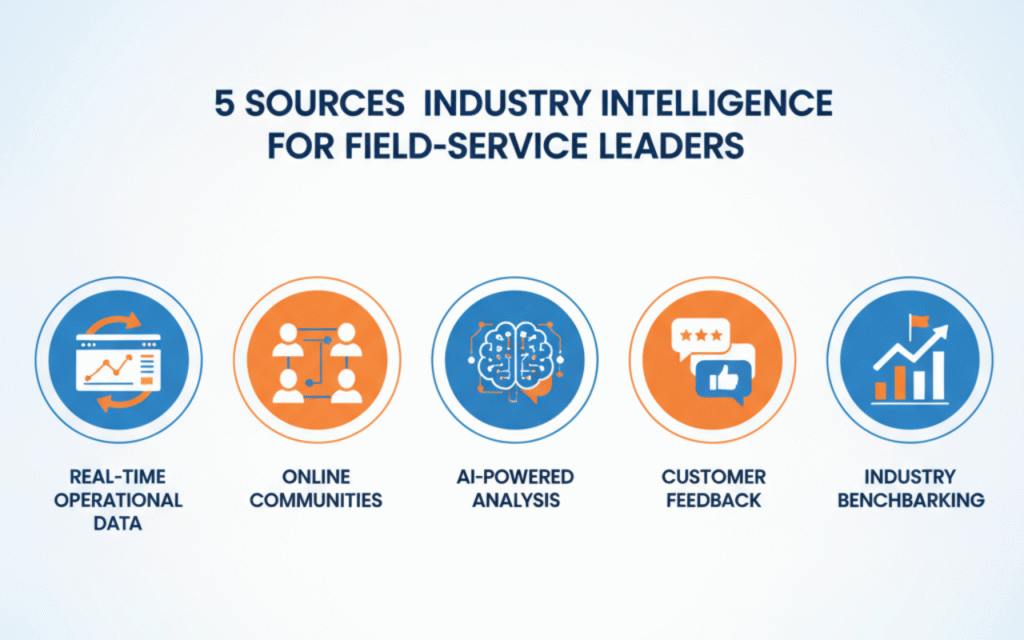

Where Smart Field-Service Leaders Get Their Insights Today

1. Real-Time Data From Your Own Operations

Many field-service businesses overlook a goldmine: their own operational data. Every job, every customer interaction, and every technician performance metric is an untapped insight source.

By systematically analyzing this data, you can identify:

- High-demand services

- Most profitable customer segments

- Operational bottlenecks

- Potential gaps in the market

Example: An HVAC company observed a 23% increase in emergency calls during Q3. Rather than just celebrating, they investigated. They found competitors were slower due to inefficient scheduling. Using AI-powered dispatch and optimized scheduling, they captured additional market share.

Action Step: Audit your current data sources. Analyze 12 months of data instead of just last month. Look for patterns and anomalies. Even small trends can provide early warning signals for opportunity or risk.

Tip: Use dashboards to visualize key metrics like job completion times, repeat service requests, and technician efficiency. Tools like Tableau or Power BI can make this process easier and actionable.

2. Industry-Specific Online Communities

Online communities are increasingly becoming real-time intelligence hubs. These are platforms where field-service professionals share insights from the front lines—far more practical than consulting reports or traditional media.

Some popular communities include:

- ServiceTitan Community: HVAC, plumbing, electrical contractors

- Trade-specific Facebook groups: Local or niche-focused groups

- Reddit communities: e.g., r/Entrepreneur or trade-specific subreddits

- LinkedIn groups: Professional networks for operational insights

Why this matters: You gain unfiltered, practical insights, often six months ahead of formal publications.

Example: A Denver contractor shared challenges with labor shortages. A plumber in Phoenix detailed which marketing strategies worked locally. By observing patterns across multiple communities, leaders spot trends and anticipate industry shifts early.

Action Step: Join 3–5 relevant communities. Spend 15 minutes daily scanning discussions for recurring themes. Track insights in a shared team document or dashboard.

3. AI-Powered Market Analysis & Competitive Intelligence

AI tools have revolutionized how field-service leaders monitor their market and competitors. They allow you to track trends, analyze customer sentiment, and even predict market shifts.

AI can help you:

- Monitor competitor activity (website updates, pricing, service offerings)

- Analyze customer sentiment across review platforms and social media

- Identify emerging market gaps via search trends

- Predict demand shifts based on economic data, weather patterns, and seasonal trends

Tools to leverage:

- Google Trends: Free tool for tracking local search trends

- Semrush & Ahrefs: Competitive intelligence and SEO insights

- ChatGPT + custom prompts: Analyze customer reviews, extract patterns, and generate insights

- Zapier + AI integrations: Automate data collection and reporting

Example: A plumbing company noticed spikes in “water heater replacement” searches during November-December via Google Trends. They launched targeted campaigns, increasing leads by 40%.

Action Step: Implement one AI-powered monitoring system this week. Start simple with Google Alerts for key industry terms and competitor names. Gradually scale to more advanced analysis using Semrush or ChatGPT workflows.

4. Systematic Customer Feedback

Your customers are a direct source of market intelligence. The most successful field-service leaders use structured feedback to uncover trends and improve offerings.

Best practices include:

- Short post-job surveys (2–3 questions)

- Recording objections from prospects who don’t convert

- Tracking feature requests and complaints

- Analyzing patterns to identify systemic issues

Example: A landscaping company discovered 30% of estimates were lost because customers found pricing unclear. By redesigning their estimate format, conversion rates increased to 65%.

Action Step: Add one simple question to your post-job follow-ups:

“What almost stopped you from hiring us?”

Over time, this feedback can reveal patterns and opportunities to improve customer satisfaction, retention, and revenue.

5. Industry Benchmarking & Performance Data

Benchmarking gives you a clear lens to measure your business against the market. Organizations such as the Service Industry Association, HVAC Excellence, and other trade-specific associations publish reports covering:

- Average job completion times

- Typical profit margins by service type

- Labor cost trends

- Customer acquisition costs

- Retention rates

By comparing your metrics, you can identify gaps and prioritize improvements.

Action Step: Find benchmarking reports for your specific trade. Select one metric where your business underperforms and create an action plan for improvement.

6. Thought Leadership & Industry Content

Successful leaders consume content strategically. Rather than passive learning, they actively translate insights into operational decisions.

Key sources include:

- Podcasts focused on service business growth

- YouTube channels covering operational efficiency

- Industry newsletters

- LinkedIn posts from successful field-service operators

Action Step: Subscribe to 3–5 sources, dedicate 30 minutes weekly, and note actionable takeaways. Ask: “How can I implement this insight this week?”

7. Market Research & Emerging Technologies

Forward-thinking field-service leaders also stay updated on emerging technologies:

- IoT-enabled devices for predictive maintenance

- AI scheduling and route optimization tools

- Mobile apps for real-time technician communication

- Automated marketing platforms to increase lead conversion

Example: A small electrical contractor adopted AI-based route optimization, reducing fuel costs by 18% and improving response times.

Action Step: Identify one emerging technology relevant to your business. Conduct a small pilot and measure impact before full-scale implementation.

Building a Sustainable Intelligence System

Collecting insights is only the first step. The key is turning information into action. Successful field-service leaders use a repeatable system:

- Collect: Internal data, online communities, AI tools, customer feedback, benchmarking reports

- Synthesize: Identify trends and patterns across all sources

- Prioritize: Focus on insights that have the highest potential impact

- Implement: Take one action at a time

- Measure: Track results and adjust based on outcomes

By applying a systematic approach, you ensure insights lead to measurable improvements, rather than just information overload.

Common Mistakes Field-Service Leaders Make

- Information Overload – Trying to consume every article, podcast, or report leads to burnout.

Fix: Stick to 3–5 trusted sources. Ignore the rest. - Insights Without Action – Reading best practices but not implementing them.

Fix: Commit to one actionable step within 7 days. - Ignoring Internal Data – Chasing external intelligence while ignoring your own operational data.

Fix: Audit your own data first; it’s often the most actionable source. - Siloed Knowledge – Failing to share insights with your team.

Fix: Share one key insight weekly and ask how it applies to their work.

People Also Ask

Q: How often should I review industry insights?

A: Weekly is ideal. Dedicate 30 minutes every Friday to review trends and plan actionable steps.

Q: What if I don’t have time to monitor all sources?

A: Start with one—your own operational data has the highest ROI.

Q: How do I know which insights actually matter?

A: Ask: “Will implementing this insight directly impact revenue, efficiency, or customer satisfaction?”

Q: Should I hire someone to do research for me?

A: Not initially. Understand your market first; then delegate parts once your system is structured.

The Bottom Line

In 2025, field-service leaders don’t wait for industry reports. They combine internal data, AI analysis, peer insights, and customer feedback into actionable intelligence systems.

The advantage isn’t having access to information—it’s turning information into action faster than competitors.

Start small: pick one source, commit to one action, measure results, and repeat. That’s how you stay ahead.

Ready to Build Your Intelligence System?

At Atlas Unchained, we help field-service businesses implement systems, automation, and data infrastructure that convert insights into real competitive advantages.

Whether it’s automated data collection, AI dashboards, or competitive intelligence tools, we’ve helped dozens of businesses move from reactive to proactive.

Schedule a consultation to build a sustainable intelligence system for your business.

FAQ

Q: What’s the fastest way to see results from insights?

A: Start with customer feedback. Fix top complaints or requests and measure impact within 30 days.

Q: How do I know if insights are actionable?

A: If they improve revenue, efficiency, or customer satisfaction, they’re actionable. Otherwise, they’re noise.

Q: Can small businesses compete with larger companies?

A: Absolutely. Small businesses are more agile and can implement changes faster than larger firms.

Q: What tools do I need to start?

A: Google Trends (free), your existing software, and ChatGPT. Start small before investing in additional tools.